Views: 0 Author: Site Editor Publish Time: 2021-12-09 Origin: Site

To run a successful business, cash on hand is essential. Many people claim that cash is disappearing, and although this may be true someday, there is still a long way to go. Many people still mainly use cash for business operations, and customers want to be able to pay for purchases in cash wherever they go.

This makes balancing your cash drawer a necessary business task. Although not the most enjoyable aspect of running a business, the correct balance of your cash drawer is essential. This task can be time-consuming, but it doesn't have to be. You can learn to speed up the process by staying organized, balancing regularly, and leveraging the data in the available software.

If balanced correctly and regularly, you will always have enough money in your cash drawer to allow your employees to complete their shifts without disrupting operations or negatively impacting services.

In order to maintain profitability, each cash drawer should be balanced at the end of each shift. If this is too frequent and you don't have enough bandwidth to do so, at least make sure to balance your cash drawer at the end of the day.

Balancing cash drawers quickly and accurately is an art, but it can be learned. Here are some tips:

Cash on hand and how much cash a company should have are critical to operating a company's profitability. The amount of cash available in the cash drawer is an important part of it. Retailers need to have enough cash in their drawers to allow employees to complete a complete shift.

Assign one person per cash drawer

You can place a cash drawer on the entire floor, but this is not recommended. The more people operate the cash drawer at a time, the harder it is to determine who is responsible when the count is insufficient.

When you let an employee operate each drawer, you can increase your sense of responsibility. Yes, you may be inclined to trust your employees, and you are right. Most employees can be trusted. But you still have a business to operate, and employee theft does happen. It makes sense to hold employees accountable when handling cash. You will ensure accurate counts at the end of each shift, and you will encounter fewer problems later.

Count cash at the beginning of the day

Many people think that cash will only be counted when the cash drawer is balanced at the end of the day.

Incorrect.

The important thing is to start each day and know what is already in the cash register. At the beginning of each day, you need to have a sufficient cash base in your cash register to ensure that you have enough funds to cover your operating expenses. This is another balancing act. Too little, and your employees may eventually run out of cash during shifts and cause detention. Too much, and you increase the possibility of employee theft.

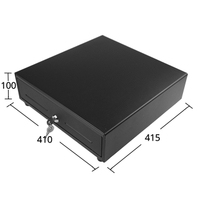

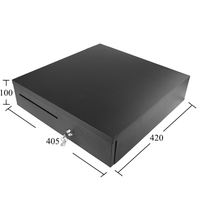

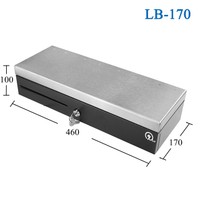

Please note: It is best to make sure that you also have a cash drawer of the right size.

Deposit cash throughout shifts

During busy shifts, it's normal for the cash register to be a little messy, $20 is too much and singles are not enough, and vice versa. Organizing cash drawers regularly throughout the day helps to ensure that your cash register is intact during the final count.

Deposit cash during periods of slow business so that you have enough cash on hand when business resumes and calculate the current situation. Be sure to eliminate the difference from the morning count, so as not to end up counting twice. It is also helpful if two people are present during the process. This helps ensure greater accuracy and greater accountability.

Pull the POS report for each drawer afterwards

Whether you balance your cash drawer at the end of each day or at the end of each shift, you need accurate data on hand to compare your counts. Whenever you close the cash drawer, pull out the point of sale report. Pop the drawer and return to a discrete location in the store to count. You need to check the count thoroughly, so make sure to give yourself enough time.

Count the cash from each drawer in a discrete location

First, perform physical counting. Count the sum of all coins, banknotes, and PDQ receipts, and compare these numbers with the totals in the report. It is not uncommon for small cash shortages or small differences to occur. Usually, by the second count, these will disappear. If the employee did not make a mistake when giving change to the customer, then everything should add up.

Identify and solve discrepancies

However, if you find a serious shortage, you need to check the data in the POS again. Most discrepancies are caused by simple human error and are not malicious. Look for shortages and surpluses. Excess means that there may be a shortage of customers, which is a problem you need to research in case you need to provide some additional training for some employees. Other discrepancies may mean that the cash is lost, stolen, or miscalculated.

To resolve this issue, please recount all cash, checks, coupons, and credit card receipts. If you can't, please check the cash register and the gray drawer around it for lost receipts. Check your POS transaction to see if you can find anything that might be lost, such as a receipt. It is also a good idea to make sure that someone can record cash differences on the small business income statement.

Record cash drawer transactions

However, if you find a serious shortage, you need to check the data in the POS again. Most discrepancies are caused by simple human error and are not malicious. Look for shortages and surpluses. Excess means that there may be a shortage of customers, which is a problem you need to research in case you need to provide some additional training for some employees. Other discrepancies may mean that the cash is lost, stolen, or miscalculated.

To resolve this issue, please recount all cash, checks, coupons, and credit card receipts. If you can't, please double check the cash register and cash drawer for missing receipts. Check your POS transaction to see if you can find anything that might be lost, such as a receipt. It is also a good idea to make sure that someone can record cash differences on the small business income statement.

What is the difference between competitor's grocery store and yours? Operating grocery stores may be a difficult career. With the rapid adjustment of the market, companies must implement new POS technology to serve customers, grow and keep profits. The ability of a retail store One-stop store has be

Global convenience stores are experiencing a transformation from once fuel-driven landscapes to offering essentials that consumers once acquired from retail stores. C-stores face abundance of macro industry and micro-level issues, from labor costs, data security vulnerabilities, credit card fees, cr

Government agencies and agencies spend trillions while hiring tens of millions people - states and places. Amass trillions of dollars through different income stream each year, there are often new business opportunities in providing POS solutions and countertop sneeze guards to the government sector

Quick Serve Restaurants (QSR) includes a quite large food industry market. In 2017, the top 20 QSR brands such as McDonald's, KFC, and pizza huts made $88.72 billion in 2017. In 2016, the number of QSRS stores nationwide was 186,977 and reached 190,494 in 2017. Hard cash exchange at quick serve rest

Hospitality includes a variety of food, accommodation and tourism services around the world. To provide millions of customers with relaxation and entertainment, the industry is seriously supervised, and it has created pressure to management. A gradually improving economy will help hospitality namely

Retail, the world's second largest sectors include various verticals, with $ 5.2 trillion in the 2017 fiscal year.Specialty, small retails and department stores are unique to retail environments.They provide a large array of footprints across the retail landscape with brands such as Neiman Marcus, L

On January 30, 1883, James Ritty, a saloonkeeper in Dayton, Ohio, and John Birch received a patent for inventing the cash register. James Ritty invented what was nicknamed the "Incorruptible Cashier" or the first working, mechanical cash register. The machine used metal taps with denominations press

A point-of-sale cash register system (or POS system) is a retail management system that helps vendors manage various aspects of their business. These are some of the basic features found in POS cash register systems: Payment processingPrinting of receipts and invoicesSales tracking and historyInvent

To run a successful business, cash on hand is essential. Many people claim that cash is disappearing, and although this may be true someday, there is still a long way to go. Many people still mainly use cash for business operations, and customers want to be able to pay for purchases in cash wherever

Bars and nightclubs represent sociable environments for patrons.With almost 1 million establishments across the country, managers and owners face the daunting task of operating these environments efficiently. Provide customers with excellent service, experience and security as well as compliance wit

Are you a POS expert that medicinal Cannabis retailer need?Due to federal legislation, US cannabis classification faces several challenges, that is, must be treated with each transaction in cash. At present, there are $ 1.67 trillion in circulation, and with cannabis sales as cash as a bidding form,